Contents

Officers of the Association 2023/24.............................................................................3

Directors of the Company 2023/24…………………………………………………………………………….3

Staff and Auditor ……………………………………………………………………………………………………........4

Chair’s Report....................................................................................................................5

Chief Officer’s Report.........................................................................................................6

Financial Report to 22 August 2023...............................................................................9

Derbyshire ALC Ltd unaudited financial statements to 31 March 2024……….......14

Appendices:

Appendix A. Representatives on Outside Bodies.......................................................22

Appendix B. Director attendance 1st April 2023 – 31st March 2024.......................23

Appendix C. Member Councils as at 31st March 2024...............................................24

Officers of the Association (to 22 Aug 2023)

CHAIR OF THE

EXECUTIVE COMMITTEE: Cllr John Plant

VICE-CHAIR OF THE

EXECUTIVE COMMITTEE: Cllr Stephanie Marbrow

CHIEF OFFICER: Wendy Amis

AUDITOR: Derby Community Accountancy Service (DCAS)

Directors of the Company

V. Broom (Appointed 17th March 2023)

S. Clough (Appointed 16th April 2024)

P. Cooper (Appointed 17th March 2023)

L. Cox (Appointed 17th March 2023)

C. Harper (Appointed 17th March 2023)

C. Hart (Appointed 17th March 2023)

T. Holmes (Appointed 17th March 2023)

S. Marbrow (Appointed 17th March 2023)

A. Nordhausen Scholes (Appointed 17th March 2023)

J. Plant (Appointed 17th March 2023)

J. Armitage (Appointed 17th March, resigned 4th Sept 2023)

3

Staff

Chief Officer: Wendy Amis

Auditor Derby Community Accountancy Service (DCAS)

Registered office Building 17 Office 3F Cromford Mills Lane Cromford Derbyshire DE4 3RQ

Accountants Derby Community Accountancy Service Babington Lodge

128 Green Lane Derby

DE1 1RY

Company registered number 14739249

4

Chair’s Report

It was a year of considerable change for DALC – in both a practical and legal sense.

In a bid to reduce overheads, DALC moved staff back to Cromford Mill, where they now occupy an office in the main mill building, and have representation on the Board of this important World Heritage Site.

From a legal perspective, DALC switched from being an unincorporated membership organisation to a company limited by guarantee – essentially to minimise the financial risk to individual DALC Executive Members (now Directors). For DALC’s member councils, there will be no impact on day-to-day delivery of services, and minimizing financial risks will hopefully encourage new members to join the DALC Board. On a practical level, the mid-year switch to limited company status means the accounts are split into two – April-August for the ‘Association’, and August-March for the company limited by guarantee.

Meanwhile, in the online world, DALC launched its new website and enquiry handling system, with members now able to access a full range of documents and track queries, in addition to being able to book places on training courses and events.

Once again, the popular DALC Day event was well attended, and included the sixth annual DALC Awards – with presentations made to winners Sheila Matthews (Blachere Illuminations Clerk of the Year), Bamford-with-Thornhill (BHIB Council of the Year), and Cllr David Williams (CCLA Councillor of the Year).

Moving forwards, the funding of DALC’s invaluable role in providing support, advice and representation for Derbyshire’s electors and parishes remains an ever-present challenge, and one which I’d urge members to fully engage with. I fully appreciate the wider financial stresses we all face, but there’s never been a more important time to ensure our sector’s voice is heard at all levels of government and beyond.

A busy year ahead beckons, with a new DALC office structure and new training courses scheduled alongside well-established topics, and closer working with DCC and other agencies.

Cllr John Plant

Chair

5

Chief Officer’s Report

Introduction

As we embarked on the 2023/24 financial year, Derbyshire ALC remained committed to providing essential support and guidance to town and parish councils across the region. The change of company status has had no impact on any of our offerings to member councils and we continue to offer tailored training programs, updates on national policy changes, and one-on-one advice, to ensure councils can manage finances responsibly, lead sustainable initiatives, and deliver high-quality services to their communities.

Membership

The 77th AGM was held online, but with a disappointing turnout, so will be face-to-face for the coming year. However, our 2023 DALC Day was well-supported and received, with a diverse set of specialist speakers, and some worthy winners of our sixth annual DALC Awards.

Advice and Information

As ever, DALC’s advice service continues to prove a valuable resource for members, with over 800 queries on a diverse range of topics. We retained the services of specialists to ensure that members receive the best possible advice regarding employment matters, finance and VAT and cemetery management. This complements the NALC legal service where an opinion can be sought when the legislation is less than clear.

6

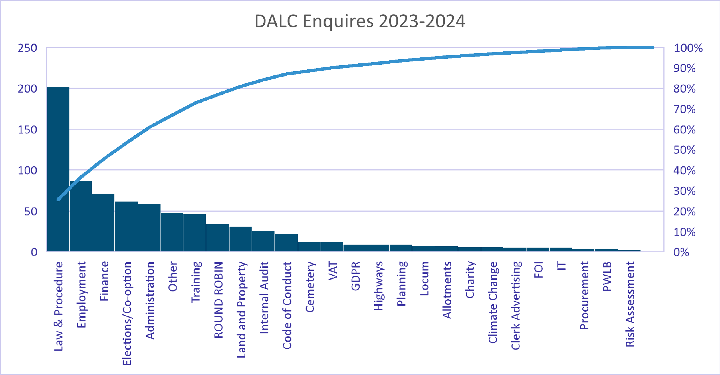

Figure 1 (below) offers a more detailed view of the scope and

distribution of enquiries, illustrating the steady reliance on our services.

Figure 1: Breakdown of enquiries by category

In similar vein, monthly forums for Clerks and Chairs were well-received, and we continue to publish monthly newsletters keeping members up-to-date with vital legal information about the sector, in addition to other relevant news and advice.

Training and Development

7

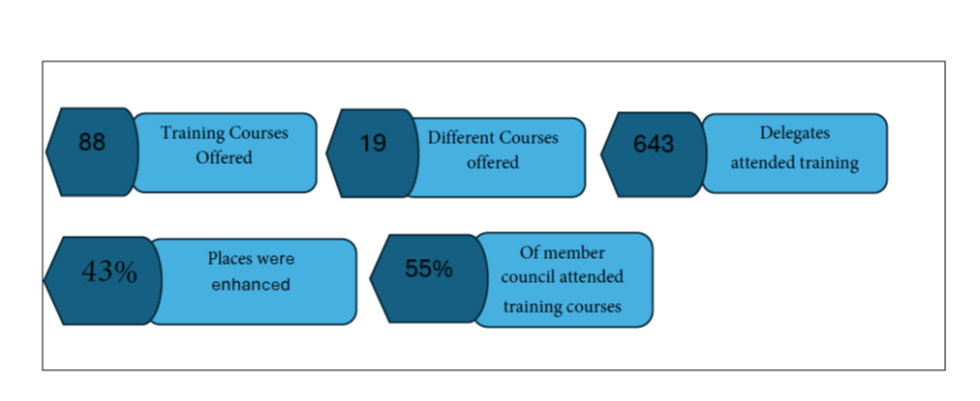

In total, DALC delivered 88 courses throughout the year, attended by 643 delegates, higher than the previous year. Of those who attended, 43% were on an enhanced member’s ticket. We have had representatives from 55% of our member councils on our training courses. We also saw 19 Clerks register for the CiLCA professional qualification.

We also delivered 19 in person bespoke sessions directly to individual councils - from Councillor Essentials and Planning, to Code of Conduct and Forward Planning.

Internal Audit and other services

Our Internal Audit service completed its second year, and we’re pleased that the uptake of this service continues to increase. So, too, does our support of councils seeking to take out loans, and those needing job evaluations for clerks and other key staff.

Working with others

We continue to work with our regional partners such as the Federation of East Midlands Association of Local Councils (FEMALC), providing opportunities to share good practice and new ideas for the sector, as well as how we can be most effective in our role.

We worked more with Derbyshire County Council, particularly on Climate Action and the Walk Derbyshire project, as well as with Campaign for the Protection of Rural England (CPRE) to develop and partner in their awards scheme.

Looking ahead

As ever, all our work here at DALC is geared towards helping our member councils be as effective as they can be in their local communities, and with a new Mayoral Authority and new legislation on the horizon, we will be at the forefront of supporting our member councils to maximise any opportunities that may bring. I look forward to an exciting and productive year ahead.

Wendy Amis

Chief Officer DALC

8

Financial Report

Independent Examiner’s Report for Derbyshire Association of Local Councils (to 22 August 2023)

I report on the accounts for the period 1 April to 22 August 2023 which are set out on pages 10-13.

Respective responsibilities of the committee and examiner

As the committee, you are responsible for the preparation of the accounts in accordance with the requirements of the Charities Act 2011 (“the Act”). I report in respect of my examination of the Trust’s accounts carried out under section 145 of the 2011 Act and in carrying out my examination, I have followed the applicable Directions given by the Charity Commission under section 145(5)(b) of the Act.

Independent examiner’s statement

I have completed my examination. I confirm that no material matters have come to my attention in connection with the examination which gives me cause to believe that in, any material respect:

• accounting records were not kept in accordance with section 130 of the Act or

• the accounts do not accord with the accounting records.

I have no concerns and have come across no other matters in connection with the examination to which attention should be drawn in order to enable a proper understanding of the accounts to be reached.

Mark Newey ACMA

Derby Community Accountancy Service

Babington Lodge

128 Green Lane

Derby DE1 1RY

FINANCIAL STATEMENTS

FOR

1 APRIL 2023 TO 22 AUGUST 2023

INCOME AND EXPENDITURE

FOR YEAR ENDED 1 APRIL 2023 TO 22 AUGUST 2023

|

|

2024 |

2023 |

|

|

£ |

£ |

|

INCOME |

|

|

|

Subscriptions |

88310 |

77043 |

|

Publication Sales |

149 |

324 |

|

Training Programme |

27637 |

24538 |

|

Trades stands and sponsorship |

1050 |

2100 |

|

Sponsorship |

1875 |

2400 |

|

Bespoke Advice |

2356 |

1762 |

|

Internal audit |

4479 |

908 |

|

Spring Seminar |

2245 |

2065 |

|

Sundry Income |

7 |

266 |

|

Interest and investments |

1126 |

1244 |

|

|

129234 |

112650 |

10

INCOME AND EXPENDITURE FOR 1 APRIL 2023 TO 22 AUGUST 2023

|

|

1 Apr to 22 Aug 2023 |

31 Mar 2023 |

|

|

£ |

£ |

|

EXPENDITURE |

|

|

|

Telephone |

227 |

1092 |

|

NALC Affiliation and meeting costs |

20953 |

25210 |

|

DALC Exec Meetings and AGM |

0 |

1812 |

|

Publications |

0 |

856 |

|

Training delivery costs |

916 |

1048 |

|

Staff training |

0 |

247 |

|

Staff Salary and on costs |

34324 |

71244 |

|

Officer Travel |

25 |

461 |

|

Office equipment |

390 |

1457 |

|

Accommodation, light and heat |

3875 |

9028 |

|

Print, post , stationery |

11 |

153 |

|

IT Provision |

1791 |

1735 |

|

Insurance |

842 |

785 |

|

Website and promotion |

0 |

180 |

|

Professional fees |

1353 |

5877 |

|

Advice services |

872 |

847 |

|

Spring Seminar |

1780 |

0 |

|

Bank charges |

44 |

88 |

|

Sundry costs |

0 |

100 |

|

Accountancy |

0 |

880 |

|

Depreciation |

428 |

623 |

|

Transfer of Assets to Derbyshire ALC Ltd |

142755 |

0 |

|

|

210586 |

123723 |

|

Surplus/(Deficit) for year |

-81352 |

-11073 |

|

Balance brought forward |

81352 |

92425 |

|

Balance carried forward |

0 |

81352 |

11

BALANCE SHEET

AS AT 22 AUGUST 2023

|

|

|

2023 |

2023 |

|

|

|

£ |

£ |

|

Fixed Assets |

|

|

|

|

Furnishings & Equipment |

note 2 |

1079 |

1507 |

|

Current Assets |

|

|

|

|

Bank account no 1 |

|

56235 |

25941 |

|

Capital Reserve |

|

27671 |

27160 |

|

The Public Sector Deposit Fund |

|

53363 |

52390 |

|

Debtors |

|

9273 |

2003 |

|

|

|

146542 |

107494 |

|

TOTAL ASSET VALUE |

|

147621 |

109001 |

|

Current Liabilities |

|

|

|

|

Trade creditors |

note 3 |

147011 |

1214 |

|

Deferred income |

|

0 |

25825 |

|

Accrued expenses |

note 4 |

610 |

610 |

|

|

|

147621 |

27649 |

|

|

|

|

|

|

TOTAL NET ASSETS |

|

0 |

81352 |

|

Represented by |

|

|

|

|

Funds |

|

0 |

92425 |

|

|

|

|

|

|

Chair |

|

Date |

|

|

Treasurer |

|

Date |

|

12

NOTES TO THE ACCOUNTS

|

Note 1 |

|

|

|

|

At 22nd August 2023 the unincorporated association, Derbyshire Association of |

|||

|

Local Councils ceased to trade and the assets were transferred to the limited |

|||

|

company Derbyshire ALC Ltd |

|

|

|

|

Note 2 |

|

|

|

|

Fixed Assets |

|

|

|

|

|

Fixtures& Fittings |

Computer Equipment |

Total |

|

|

£ |

£ |

£ |

|

At Cost as at 1 April 2023 |

1065 |

6549 |

7614 |

|

Additions in the year |

0 |

0 |

0 |

|

At Cost as at 22 August 2023 |

1065 |

6549 |

7614 |

|

Depreciation at 1 April 2023 |

663 |

5444 |

6107 |

|

Depreciation charge for the year |

60 |

368 |

428 |

|

Depreciation at 22 August 2023 |

723 |

5812 |

6535 |

|

NET VALUE |

342 |

737 |

1079 |

|

Note 3 |

|

|

|

|

Creditors |

|

As at 22 August 2023 |

As at 31 March 2023 |

|

|

|

£ |

£ |

|

Wage costs |

|

791 |

0 |

|

Pension cost |

|

2504 |

0 |

|

HM Revenue and Customs |

|

961 |

1214 |

|

Transfer of Assets to Derbyshire ALC Ltd |

|

142755 |

0 |

|

|

|

147011 |

1214 |

|

Note 4 |

|

|

|

|

|

|

As at 22 August 2023 |

As at 31 March 2023 |

|

Accrued Expenses |

|

£ |

£ |

|

Accountancy costs |

|

610 |

610 |

13

DERBYSHIRE ALC LTD UNAUDITED FINANCIAL STATEMENTS

31 MARCH 2024

THE DIRECTORS' REPORT YEAR ENDED 31 MARCH 2024

Introduction

The directors have pleasure in presenting their report and the unaudited financial statements of the company for the year ended 31 March 2024.

Incorporation

The company is a not-for-profit organisation under the Memorandum and Articles of Association and was incorporated on 17 March 2023.

Principal activities

To provide a membership services to local councils in Derbyshire.

Small company provisions

This report has been prepared in accordance with the special provisions for small companies under section 477 of the Companies Act 2006.

14

PROFIT AND LOSS ACCOUNT YEAR ENDED 31 MARCH 2024

Year to 31 Mar 24

Note £

|

Turnover |

150,632 |

|

Administration expenses |

69,929 |

|

|

- |

|

Operating profit |

80,703 |

|

Interest receivable |

2,219 |

|

|

- |

|

Profit on ordinary activities before taxation 6 |

82,922 |

|

Tax on profit on ordinary activities |

- |

- -

Profit/ (Loss) for the financial period 82,922

=

15

BALANCE SHEET 31 MARCH 2024

2024

Note £ £

Fixed assets 3 1,079 -

Current Assets

Debtors 4 -

Cash at bank and in hand 102,965

- -

102,965

Creditors: amounts falling due

within one year 5 (21,122)

- -

Net current assets 81,843

-

Total assets less current liabilities 82,922

=

Capital and reserves

Profit and loss account | 6 | 82,922 | |

|

| - | |

Funds |

| 82,922 | |

|

| = |

The directors are satisfied that the company is entitled to exemption from the provisions of the Companies Act 2006 (the Act) relating to the audit of the financial statements for the year by virtue of section 477, and that no member or members have requested an audit pursuant to section 476 of the Act.

The directors acknowledge their responsibilities for:

(i) ensuring that the company keeps adequate accounting records which comply with section 386 of the Act, and

(ii) preparing financial statements which give a true and fair view of the state of affairs of the company as at the end of the financial year and of its profit or loss for the financial year in accordance with the requirements of sections 394 and 395, and which otherwise comply with the requirements of the Act relating to financial statements, so far as applicable to the company.

These financial statements have been prepared in accordance with the special provisions for small companies under Part 15 of the Companies Act 2006.

These financial statements were approved by the directors and authorised for issue and are signed on their behalf by:

J. Plant

Director Date

16

NOTES TO THE FINANCIAL STATEMENTS YEAR ENDED 31 MARCH 2024

(i) Accounting policies

The principal accounting policies adopted, judgements and key sources of estimation uncertainty in the preparation of the financial statements are as follows:

Company information

Derbyshire ALC Limited is a company limited by guarantee not having a share capital. The company’s registered office is Building 17, Room 3F, Cromford Mill, Mill Lane, Cromford, DE4 3RQ. There are 9 Directors each of whom, under the terms of the Memorandum and Articles of Association, had undertaken to contribute the sum not exceeding £1 in the event of a winding up of the company.

• Accounting convention

These accounts have been prepared in accordance with FRS 102, “The Financial Reporting Standard applicable in the UK and Republic of Ireland” (“FRS 102, the Companies Act 2006 and UK Generally Accepted Accounting Practice as it applies from 1 January 2015. The company is a Public Benefit Entity as defined by FRS 102.

The accounts are prepared in Sterling which is the functional currency of the company Monetary amounts in these financial statements to the nearest £.

The accounts have been prepared on historical cost convention apart from freehold property that is carried at market value. The principal accounting policies adopted are set out below.

• Going concern

At the time of approving the accounts, the directors have a reasonable expectation that the company has adequate resources to continue in operational existence for the foreseeable future. Thus the Directors continue to adopt the going concern basis of accounting in preparing the accounts.

• Charitable Funds

Unrestricted funds are available for use at the discretion of the directors in furtherance of the general objectives of the company.

Designated funds are unrestricted funds earmarked by the directors for particular purposes.

Restricted funds are subjected to restrictions on their expenditure imposed by the donor or through the terms of an appeal.

• Incoming resources

All incoming resources are included when the company is legally entitled to the income and the amount can be quantified with reasonable accuracy. Gifts in kind have been included at market value of gifts received and in assets acquired. No amounts are included in the financial statements for services donated by volunteers.

17

NOTES TO THE FINANCIAL STATEMENTS YEAR ENDED 31 MARCH 2024

• Resources expended

All expenditure is accounted for on an accruals basis and has been classified under headings that aggregate all costs relating to the category. Where costs cannot be directly attributed to particular headings they have been allocated to activities on a basis consistent with use of the resources. Fund-raising costs are those incurred in seeking voluntary contributions and do not include the costs of disseminating information in the support of the charitable activities.

• Debtors

Trade and other debtors are recognised at the settlement amount due after any trade discounts offered. Prepayments are valued at the amount prepaid net of any trade discounts due.

• Cash and cash equivalents

Cash and cash equivalents include cash in hand, deposits held at call with banks, other short- term liquid investments with original maturities of three months or less, and bank overdrafts. Bank overdrafts are shown within borrowings in current liabilities.

• Creditors and provisions

Creditors and provisions are recognised where the company has a present obligation resulting from a past event that will probably result in the transfer of funds to a third party and the amount due to settle the obligation can be measured or estimated reliably. Creditors and provisions are normally recognised at their settlement amount after allowing for any trade discounts due.

• Financial instruments

The company has financial assets and financial liabilities of a kind that qualify as basic financial instruments. Basic financial instruments are initially recognised at transaction value and subsequently measured at their settlement value.

Derecognition of financial liabilities

Financial liabilities are derecognised when the company’s contractual obligations expire or are discharged or cancelled.

• Employee benefits

The cost of any unused holiday entitlement is recognised in the period in which the employee’s services are received.

Termination benefits are recognised immediately as an expense when the company is demonstrably committed to terminate the employment of an employee or to provide termination benefits.

• Taxation

The company is exempt from tax on income and gains falling with section 505 of the Taxes Act 1988 or section 252 of the Taxation of Chargeable Gains Act 1992 to the extent that these are applied to its charitable objects.

1.12 Depreciation

NOTES TO THE FINANCIAL STATEMENTS YEAR ENDED 31 MARCH 2024

Individual fixed assets costing £1,000 or more are capitalised at cost and are depreciated over their estimated useful economic lives on a reducing balance basis as follows:-

Asset category Annual rate

Fixtures

and Fittings 15%

18

Computers 33%

(i) Critical accounting estimates and judgements

In the application of the company’s accounting policies, the directors are required to make judgements, estimates and assumptions about the carrying amount of assets and liabilities that are not readily apparent from other sources. The estimated and associated assumptions are based on historical experience and other factors that are considered to be relevant. Actual results may differ from these estimates.

(ii) Fixed Assets

|

Fixtures Fittings |

Computers |

Total |

|

£ |

£ |

£ |

Cost

|

At 23 August 2023 |

1,065 |

6,549 |

7,614 |

|

Additions |

- |

- |

- |

|

Disposals |

- |

- |

- |

|

|

- |

- |

- |

|

At 31 March 2024 |

1,065 |

6,549 |

7,614 |

|

|

= |

= |

= |

Depreciation

|

At 23 August 2023 |

723 |

5,812 |

6,535 |

|

Depreciation on Disposal |

- |

- |

- |

|

Charge for the year |

- |

- |

- |

|

|

- |

- |

- |

|

At 31 March 2024 |

723 |

5,812 |

6,535 |

|

|

= |

= |

= |

Net book value

|

At 31 March 2024 |

342 |

737 |

1,079 |

|

|

= |

= |

= |

4. Debtors

|

|

2024 |

|

|

£ |

|

Sundry debtors |

- |

|

|

-------------------------------- |

|

|

- |

|

|

= = = |

NOTES TO THE FINANCIAL STATEMENTS YEAR ENDED 31 MARCH 2024

5. Creditors: Amounts falling due within one year

|

|

2024 |

|

|

£ |

|

Deferred income |

17,030 |

|

HM Revenue and Customs |

1,351 |

|

Wages and pension contributions |

2,131 |

|

Accountancy fees |

610 |

|

|

-------------------------------- |

|

|

21,122 |

|

|

= |

6. Profit and loss account

|

|

Year to |

|

|

31 Mar 24 |

|

|

£ |

|

Profit for the financial year |

82,922 |

|

Reserves brought forward |

- |

|

|

-------------------------------- |

|

Balance carried forward |

82,922 |

|

|

= = = |

7. Related party transactions

The company had no related party transactions that required disclosure.

19

EXAMINER’S REPORT TO THE BOARD OF DIRECTORS

ON THE UNAUDITED FINANCIAL STATEMENTS OF

YEAR ENDED 31 MARCH 2024

In accordance with our terms of engagement, and in order to assist you to fulfil your duties under the Companies Act 2006, we have compiled the financial statements of the company which comprise the Profit and Loss Account, Balance Sheet and the related notes from the accounting records and information and explanations you have given to us.

This report is made to the Company's Board of Directors, as a body, in accordance with the terms of our engagement. Our work has been undertaken so that we might compile the financial statements that we have been engaged to compile, report to the Company's Board of Directors that we have done so, and state those matters that we have agreed to state to them in this report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Company and the Company's Board of Directors, as a body, for our work or for this report.

You have acknowledged on the balance sheet as at 31 March 2024 your duty to ensure that the company has kept proper accounting records and to prepare financial statements that give a true and fair view under the Companies Act 2006. You consider that the company is exempt from the statutory requirement for an audit for the year.

We have not been instructed to carry out an audit of the financial statements. For this reason, we have not verified the accuracy or completeness of the accounting records or information and explanations you have given to us and we do not, therefore, express any opinion on the financial statements.

Derby Community Accountancy Service

Babington Lodge 128 Green Lane Derby

DE1 1RY

Date

20

EXAMINER’S REPORT TO THE

BOARD OF DIRECTORS

ON THE UNAUDITED FINANCIAL STATEMENTS OF

YEAR ENDED 31 MARCH 2024

In accordance with our terms of engagement, and in order to assist you to fulfil your duties under the Companies Act 2006, we have compiled the financial statements of the company which comprise the Profit and Loss Account, Balance Sheet and the related notes from the accounting records and information and explanations you have given to us.

This report is made to the Company's Board of Directors, as a body, in accordance with the terms of our engagement. Our work has been undertaken so that we might compile the financial statements that we have been engaged to compile, report to the Company's Board of Directors that we have done so, and state those matters that we have agreed to state to them in this report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Company and the Company's Board of Directors, as a body, for our work or for this report.

You have acknowledged on the balance sheet as at 31 March 2024 your duty to ensure that the company has kept proper accounting records and to prepare financial statements that give a true and fair view under the Companies Act 2006. You consider that the company is exempt from the statutory requirement for an audit for the year.

We have not been instructed to carry out an audit of the financial statements. For this reason, we have not verified the accuracy or completeness of the accounting records or information and explanations you have given to us and we do not, therefore, express any opinion on the financial statements.

Derby Community Accountancy Service

Babington Lodge 128 Green Lane Derby

DE1 1RY

Date

21

Appendix B. Director attendance 1st April 2023 – 31st March 2024

Directors attendance record are shown below:

District Name Council Score

Amber Valley Cllr V Broom Crich 3 out of 3

Cllr L Cox Ripley 1 out of 3

Cllr T Holmes Ripley 1 out of 3

Bolsover

Derbyshire Dales Cllr C J Plant Eyam 3 out of 3

Erewash Cllr C Hart West Hallam 2 out of 3

High Peak Cllr A Nordhausen Scholes Bamford

with Thornhill 2 out of 3

Cllr P Cooper Charlesworth 3 out of 3

North East Cllr C Harper Wingerworth 1 out of 3

South Derbyshire Cllr S Marbrow Rosliston 2 out of 3

Chesterfield

22

Appendix C. Member Councils as at 31st March 2024

AMBER VALLEY

|

Aldercar & Langley Mill |

Holbrook |

Quarndon |

|

Alderwasley |

Horsley |

Ripley |

|

Belper |

Horsley Woodhouse |

Shipley |

|

Codnor |

Idridgehay, Alton & Ashleyhay |

Shottle & Postern |

|

Crich |

Ironville |

Smalley |

|

Denby |

Kilburn |

Somercotes |

|

Dethick, Lea & Holloway |

Kirk Langley |

South Wingfield |

|

Duffield |

Mackworth |

Swanwick |

|

Hazelwood |

Mapperley |

Turnditch & Windley |

|

Heanor & Loscoe |

Pentrich |

Weston Underwood |

TOTAL : 30 (+ 1 Non Member Council – Alfreton)

BOLSOVER DISTRICT

|

Ault Hucknall |

Old Bolsover |

South Normanton |

|

Blackwell |

Pinxton |

Tibshelf |

|

Clowne |

Pleasley |

Whitwell |

|

Hodthorpe & Belph |

Scarcliffe |

|

TOTAL: 10 (+ 6 Non Member Councils – Barlborough, Langwith, Elmton with Creswell, Glapwell and Shirebrook)

CHESTERFIELD BOROUGH

|

Brimington |

|

|

|

|

|

|

TOTAL 1 (+ 1 Non-Member – Staveley)

23

DERBYSHIRE DALES DISTRICT

|

Ashbourne |

Eyam |

Norbury & Roston |

|

Ashford |

Fenny Bentley |

Northwood and Tinkersley |

|

Bakewell |

Flagg |

Offcote & Underwood |

|

Ballidon & Bradborune |

Great Hucklow, Little Hucklow & Grindlow |

Osmaston & Yeldersley |

|

Beeley |

Great Longstone |

Over Haddon |

|

Birchover |

Grindleford |

Parwich |

|

Bonsall |

Hartington Nether Quarter |

Rodsley & Yeaveley |

|

Boylestone |

Hartington Town Quarter |

Rowsley |

|

Bradley |

Hathersage |

Shirley |

|

Bradwell |

Hognaston |

South Darley |

|

Brailsford |

Hollington |

Stanton in Peak |

|

Brassington |

Hulland Ward |

Stoney Middleton |

|

Calver |

Kirk Ireton |

Sudbury |

|

Carsington & Hopton |

Kniveton |

Taddington & Priestcliffe |

|

Chelmorton |

Litton |

Thorpe |

|

Cromford |

Longford |

Tideswell |

|

Cubley |

Mappleton |

Tissington |

|

Curbar |

Marston Montgomery |

Winster |

|

Darley Dale |

Matlock Bath |

Wirksworth |

|

Doveridge |

Matlock |

Youlgrave |

|

Eaton, Alsop & Newton Grange |

Middleton |

|

|

Edlaston & Wyaston |

Middleton & Smerrill |

|

|

Elton |

Monyash |

|

TOTAL 66 (+ 5 Non-Member Councils – Alkmonton & Hungry Bentley, Baslow & Bubnell, Clifton, Hartington Middle Quarter, Tansley)

+ 3 PARISH MEETINGS (Little Longstone, Sheldon and Wardlow)

24

EREWASH BOROUGH

|

Breadsall |

Morley |

Stanley & Stanley Common |

|

Breaston |

Ockbrook & Borrowash |

Stanton by Dale |

|

Dale Abbey |

Risley with Hopwell |

West Hallam |

|

Draycott |

Sandiacre |

|

|

Little Eaton |

Sawley |

|

TOTAL 13

HIGH PEAK BOROUGH

|

Bamford with Thornhill |

Derwent & Hope Woodlands |

Peak Forest |

|

Castleton |

Edale |

Tintwistle |

|

Chapel-en-le-Frith |

Hartington Upper Quarter |

Whaley Bridge |

|

Charlesworth |

Hayfield |

Wormhill & Greenfairfield |

|

Chinley, Buxworth & Brownside |

Hope with Aston |

|

|

Chisworth |

New Mills |

|

TOTAL 16

25

NORTH EAST DERBYSHIRE DISTRICT

|

Ashover |

Holmesfield |

Sutton cum Duckmanton |

|

Barlow |

Killamarsh |

Temple Normanton |

|

Brackenfield |

Morton |

Unstone |

|

Brampton |

North Wingfield |

Wessington |

|

Calow |

Pilsley |

Wingerworth |

|

Dronfield |

Shirland & Higham |

|

|

Eckington |

Stretton |

|

TOTAL 19 (+ 5 Non-Member Councils – Holymoorside & Walton, Clay Cross, Grassmoor, Hasland & Winsick, Heath & Holmewood and Tupton)

SOUTH DERBYSHIRE DISTRICT

|

Bretby |

Foston & Scropton |

Shardlow & Great Wilne |

|

Burnaston |

Hartshorne |

Smisby |

|

Castle Gresley |

Hatton |

Stenson Fields |

|

Coton in the Elms |

Linton |

Ticknall |

|

Church Broughton |

Melbourne |

Walton on Trent |

|

Dalbury Lees |

Netherseal |

Weston on Trent |

|

Egginton |

Newton Solney |

Willington |

|

Elvaston |

Overseal |

Woodville |

|

Etwall |

Repton |

|

|

Findern |

Rosliston |

TOTAL 28 (+ 3 Non Member Councils – Aston on Trent, Barrow on Trent and Hilton)

+ 1 PARISH MEETING (Drakelow

Parish Meeting)